Empowering Filipinos with Reliable Banking Solutions

Start your journey toward financial growth with the Bank of Makati. Whether you need savings, loans, or business solutions, we’re here to help.

Bank of Makati on March 23, 2015 joined the big players in the banking industry as it officially became Bank of Makati (A Savings Bank), Inc.

Built on more than 60 years of experience in community banking, BMI was originally founded as a rural bank in July 1956. Since then, it has helped countless Filipino savers and entrepreneurs achieve their dreams.

BMI gained stronger capability with the coming in of new shareholders, a new management and bigger capitalization.

BMI reached the elite list of the Top 1,000 Corporations in the Philippines, the first rural bank to do so. With total assets of Php5.2 billion and a net worth of over Php800 million, the Bank was recognized in the same year as the biggest rural bank in the Philippines – bigger, in fact, than most savings bank.

BMI sported a new logo. Corollary to this, a new tagline came into being: “Malalapitan, Maaasahang Kaibigan.” The tagline depicted the Bank as a friend who reaches out, understands and can be counted on in times of need.

The Bank stepped up preparations for a seamless upgrade to savings bank with the implementation of a new five-year plan. It became an allied member of the Bancnet ATM Consortium, expanded its reach in Metro Manila with its microfinance-oriented branches and opened more loan centers.

BMI converted its core banking system to Finacle, an integrated system that automates both deposit and loan processing to support ATM, mobile and internet banking.

In the past couple of years, BMI’s growth was nothing short of phenomenal. The Bank's capital now stands at almost Php5.8 billion. It has deployed 10 ATMs and will soon issue its own ATM cards. A network of 19 full-service branches, 24 loan centers and 13 microfinance-oriented Metro Manila branches are now in place, with more in the pipeline. Following the approval by the Bangko Sentral ng Pilipinas to operate as a thrift bank, BMI on April 28, 2015 officially became a savings bank.

On this year, BMI marked its 60th anniversary, continuing its strong financial performance. With the conversion of its loan centers, BMI closed the year with 60 branches, including 14 microfinance-oriented ones located in Metro Manila. The Bank put in place an automated credit investigation system that uses android phones to better serve our borrowing public. It became 100% compliant with guidelines on the new check clearing system (CICs).

Bank of Makati (A Savings Bank), Inc. sees no let up in its bid to make a significant contribution to nation-building. It is committed to serve and to make better banking options available to the public. Its vision is to be the Micro, Small and Medium Enterprises (MSME) bank of choice.

LWe’re here to help Filipinos build a secure and prosperous future with reliable banking solutions.

Bank of Makati envisions itself as a leading thrift bank that fuels the growth of aspiring and existing mSMEs as well as advocates for the financial inclusion of the ordinary and unbanked Filipino.

Bank of Makati is committed to realizing its vision by offering simple, convenient, and transparent financial products and services, meeting customer needs through an integrated network of touchpoints. The bank pursues consistent growth and profitability while supporting sustainability. Internally, it fosters a culture emphasizing customer understanding, service urgency, and accountability, creating a workplace that encourages employee excellence and commitment to the bank’s purpose.

With deep roots in banking, the Bank of Makati has been a trusted partner in financial growth. Our solutions make banking accessible and reliable for individuals and businesses in the Philippines.

We make banking simple and built around your needs, making managing your finances effortless.

From saving for the future to expanding your business, we’re here to help you reach your goals.

Wherever life takes you, Bank of Makati is here to provide the banking support you need.

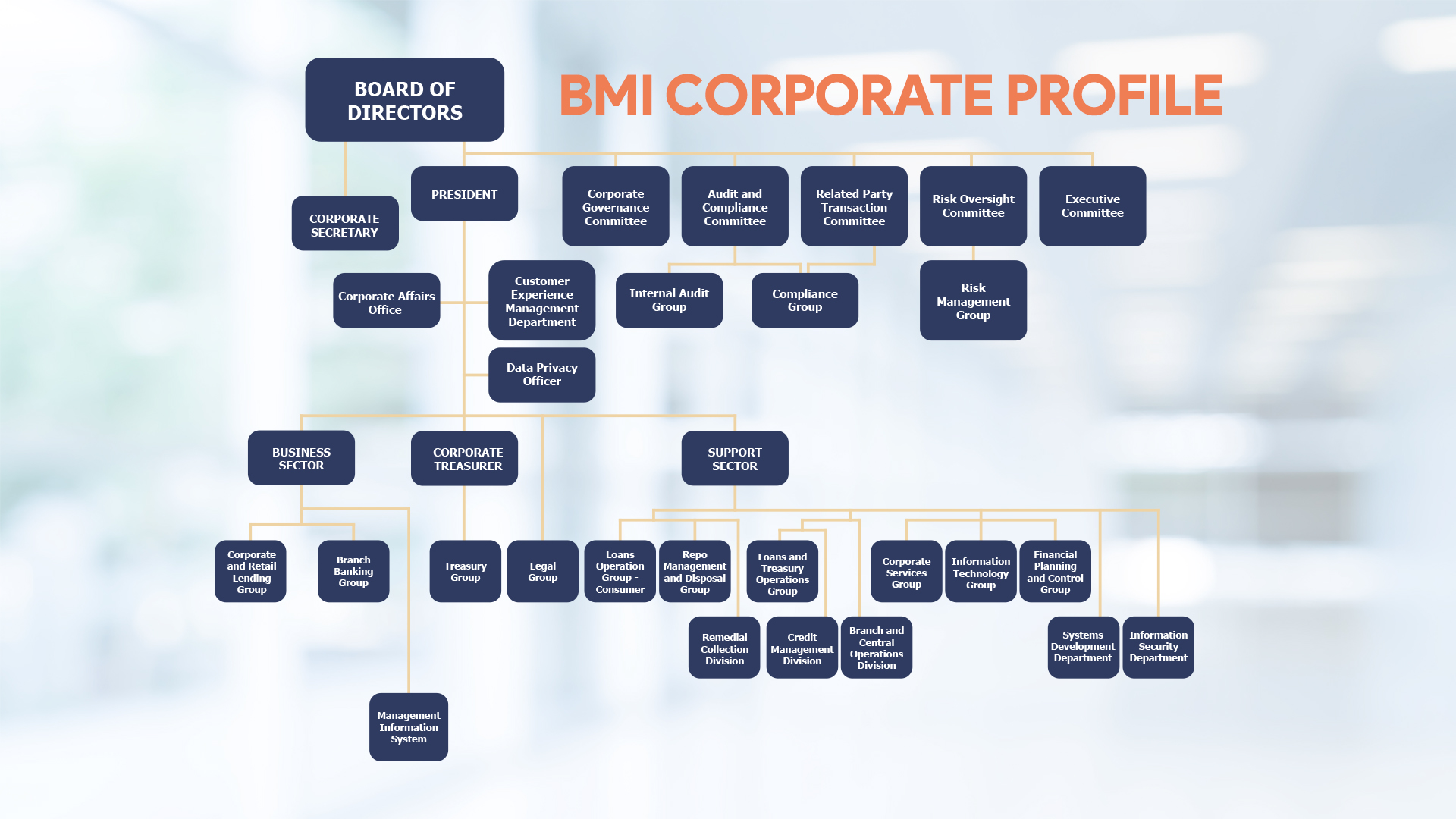

At Bank of Makati, our leaders bring expertise and vision to ensure we provide secure and accessible financial solutions that help you grow.

At BMI, our leadership team is committed to making banking simple, efficient, and accessible. With a structure built for innovation and reliability, we ensure our services support your financial growth.

Do you need banking support or have questions? Our team is ready to help with solutions tailored to your needs.