Empowering Small Businesses with Accessible Financing

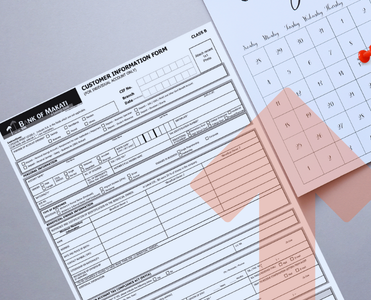

Our Microfinance Loan supports small entrepreneurs by providing quick and affordable funding to grow their businesses. With simple requirements and flexible terms, we make financial inclusion possible for every Filipino.